Private Equity

Stakeholder

Project

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project

KEY POINTS

• Private equity and debt firm Cerberus Capital Management

has multiple portfolio companies active in the housing

sector.

• Through its single-family home rental company, FirstKey

Homes, Cerberus owns over 20,000 homes across the US.

• FirstKey has filed to evict residents at high rates in cities

such as Memphis, Atlanta, and Phoenix.

• Despite the COVID-19 pandemic, Cerberus has advanced

eviction cases against some residents of its single-family

rental homes.

• In Memphis, TN, FirstKey has been cited dozens of times

for code violations at homes it owns.

• Cerberus’ FirstKey competes with individual homebuyers,

making it more difficult for first time homebuyers to

purchase homes.

• In the United Kingdom, Cerberus owns mortgage manage-

ment company Landmark Mortgages, which has been

criticized for keeping homeowners in “mortgage prisons”.

A

pril 2020

CERBERUS CAPITAL MANAGEMENT’S THREE-

HEADED ATTACK ON HOMEOWNERS, TENANTS

THE PRIVATE EQUITY GIANT’S FORAYS INTO THE SINGLE-FAMILY HOME

RENTAL AND MORTGAGE BUSINESS HAVE HARMED RENTERS,

PROSPECTIVE HOMEBUYERS, AND HOMEOWNERS.

CERBERUS CAPITAL MANAGEMENT

Cerberus Capital Management LP is an alternative

investment firm founded by Stephen Feinberg and William

Richter in 1992. The New York-based firm, with $42 billion

in assets under management, focuses on private equity and

real estate investments.

1

Cerberus’s executives have close ties to federal politics.

Feinberg serves as chair of Donald Trump’s Presidential

Intelligence Advisory Board

2

, and there are two notable

Cerberus board members as well: Dan Quayle, who was Vice

President of the United States under George H.W. Bush

3

,

and John Snow, United States Treasury Secretary under

George W. Bush.

4

CERBERUS’S INVESTMENTS IN MORTGAGES,

RENTAL PROPERTIES

Cerberus has long been an active investor in US housing,

investing primarily in residential mortgages and single-family

CERBERUS CAPITAL MANAGEMENT’S THREE-HEADED ATTACK ON HOMEOWNERS, TENANTS

2

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project

homes that the firm converts to rental properties. Cerberus established its “Residen-

tial Opportunities” platform in 2008 to “capitalize on opportunities to acquire

distressed residential mortgage-backed securities following the Global Financial

Crisis.”

5

In 2013, FirstKey Mortgage began operations as Cerberus’s mortgage securitization

company. It services, facilitates, and acquires large-scale mortgage packages.

6

Cerberus formed FirstKey Homes in 2014 as a vehicle for single-family housing

acquisitions. With more than 21,000 homes in the US throughout 26 markets, the

landlord is poised to continue to grow. In 2018, FirstKey Homes CEO Martin

Esteverena said that the company, then with a portfolio of 14,000 homes, planned

to triple its size.

7

In the United Kingdom, Cerberus-owned Landmark Mortgages Limited manages

a portfolio of mortgages that it acquired from UK Asset Resolution (UKAR), an arm

of the government, established in response to the global financial crisis.

8

FIRSTKEY HOMES SERVING EVICTION NOTICES TARGETING CERTAIN AREAS

In December 2018, an investigation by the Washington Post reported that in the

Memphis, Tennessee area, FirstKey Homes was responsible for twice as many

eviction filings of any other rental home property manager.

9

According to the Post, FirstKey Homes leases allowed residents only five days after

the due date to pay rent before being hit with a 10 percent late fee. Previously,

residents had 10 days to come up with rent.

10

In order to provide “a competitive edge to [its] single-family rental strategy in a

scalable and efficient manner,” FirstKey Homes files eviction notices at higher rates

than peers.

11

FirstKey was the largest single family home landlord In the Memphis area as of

2018, with nearly 1,800 houses. According to the Post’s analysis, FirstKey also

filed for eviction at twice the rate of any other single-family rental property manager

there. In the first three quarters of 2018, FirstKey’s filings amounted to 435 eviction

notices.

12

FirstKey has continued to file large numbers of eviction filings in Memphis. In the

first two months of 2020, FirstKey filed 89 eviction filings in Shelby County, where

Memphis is located.

13

According to the company, the eviction notices were not filed with the intent to

actually evict residents, but to motivate residents to pay rent quickly. Known as “pay

and stay,” tenants can pay what is owed up until the time of stated eviction while

staying in their home. With each filing, though, the company collects more on

penalties and fees.

14

The Washington Post story detailed the story of Cassandra and Terry Brown. The

Browns paid $965 a month to rent the same home they had owned before losing it

in the 2008 financial crisis. In 2018, Cassandra was back in eviction court battling

a balance that started at $1,058 but had grown to $2,243. Included in the penalty

was a 10 percent late fee and an attorney’s fee. By the time Ms. Brown faced a judge

she owed more than double the rent due. The Brown family had faced eviction four

times since FirstKey Homes had owned their home.

15

Similarly, FirstKey resident Marrena Shorter faced eviction 11 times in four years.

The Memphis Housing Authority covered nearly a third of her $1,200 rent while she

covered the rest through work as a cook at a hospital, struggling to pay on time while

looking after her disabled son.

16

C

ITY STATE HOMES FOR

RENT AS OF

2/24/20

Atlanta GA 159

Indianapolis IN 126

Charlotte NC 93

Miami FL 84

Orlando FL 79

Kansas City MO 78

Chicago IL 72

Dallas TX 64

Houston TX 61

Winston-

Salem NC 57

Phoenix AZ 47

Memphis TN 47

Las Vegas NV 43

St. Louis MO 35

Tampa FL 35

Birmingham AL 31

Jacksonville FL 25

Raleigh-

Durham NC 24

Fort Myers FL 24

Kansas City KS 11

Cincinnati OH 10

San Antonio TX 9

Charleston SC 7

Columbus OH 2

Louisville KY 0

FIRSTKEY HOMES MARKETS

CERBERUS CAPITAL MANAGEMENT’S THREE-HEADED ATTACK ON HOMEOWNERS, TENANTS

3

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project

CLAYTON COUNTY, GEORGIA

FirstKey’s aggressive evictions do not appear to be isolated to Memphis.

An analysis of eviction filings in Clayton County, Georgia, for example, shows similar

eviction practices by FirstKey Homes.

Clayton Country consists of six municipalities in the suburbs of Atlanta, Georgia—

College Park, Forest Park, Jonesboro, Lake City, Lovejoy, Morrow, and Riverdale. Ac-

cording to the county’s real property records, as of February 2020, Cerberus SFR

Holdings LP and Cerberus SFR Holdings II LP own 328 homes in the county.

17

In just 22 months, between May 2018 and February 2020, FirstKey Homes or

Cerberus entities filed for eviction at least 222 times through the Clayton County

Magistrate Court.

18

The company filed for eviction against seven individuals at least four times in less

than two years.

Filing for eviction against 127 households out of 328 households is a 40 percent

rate of filing, assuming all homes are occupied.

RENTAL HOMES MANAGED BY FIRSTKEY FOR CERBERUS CONSISTENTLY HAVE A

HIGHER RATE OF EVEICTION FILINGS THAN OTHER SINGLE-FAMILY RENTALS IN

THE SAME AREA

Evictions per 100 homes in Zip codes where Cerberus owns more than 20 rentals and made at

least nine eviction filings from September 2015 to October 2018

Totals in some zip codes are greater than 100 because of multiple eviction filings against one property.

Source: Shelby County, Tenn., General Sessions Court

Armand Emamdjomeh and Dan Keating/The Washington Post

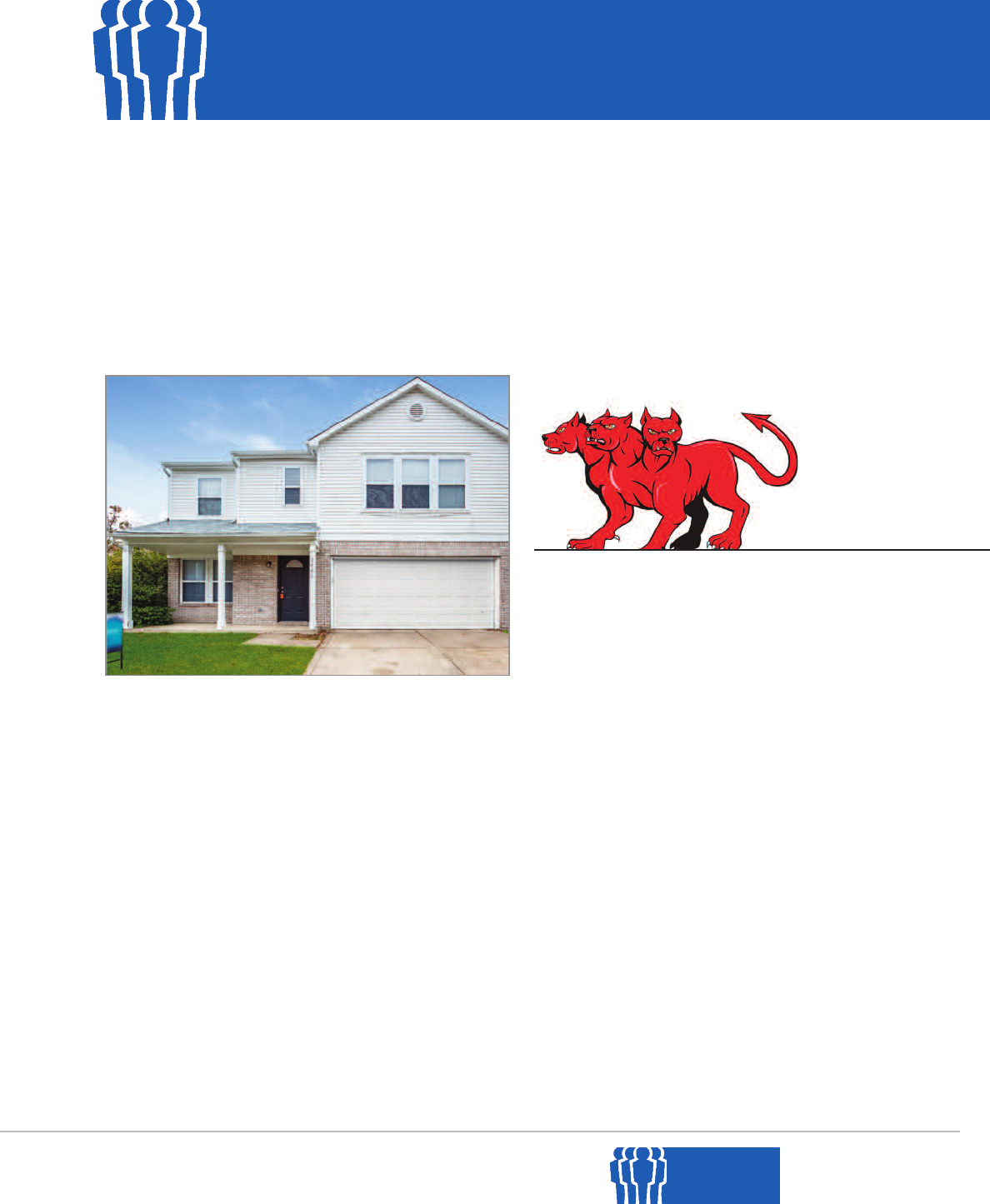

FirstKey Home in Riverdale, GA in Clayton County, where 38.7 percent of the

homes are targeted for eviction. Photo courtesy of FirstKey Homes

CERBERUS CAPITAL MANAGEMENT’S THREE-HEADED ATTACK ON HOMEOWNERS, TENANTS

4

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project

CERBERUS CONTINUES TO ADVANCE SOME EVICTIONS

DURING COVID-19 PANDEMIC

While state and federal authorities have advised people to stay at home during

the COVID-19 pandemic and federal lawmakers and a number of states and cities

have called for a halt to evictions, Cerberus has advanced some eviction cases at its

single-family rental homes.

For example:

• On March 18, 2020 FirstKey Homes filed an eviction case against a tenant in

Clayton County, Georgia.

19

• On March 27, Cerberus SFR Holdings LP filed a motion for clerk’s default against

a tenant in an eviction case in Miami-Dade County.

20

On March 19, Cerberus had

served notice to the tenant, stating: “You are being sued by CERBERUS SFR

HOLDINGS, LP, a Delaware Limited Partnership, to require you to move out of the

place you are living for the reasons given in the attached complaint.” The notice

advised the tenant to “Write down the reason(s) why you think you should not be

forced to move.”

2

1

• On March 23, Cerberus SFR Holdings LP filed a motion for default judgment

against tenants in Broward County, Florida, where it asked the court to “Enter a

Final Judgment for Residential Eviction against Defendants.”

22

• Cerberus has several active eviction cases in Cook County, Illinois, though the cases

have been continued until late May and June by orders of local judges.

Cerberus reports that it has halted new eviction filings during the pandemic.

FIRSTKEY CODE VIOLATIONS

In addition to aggressive eviction filings, the Washington Post also reported that

FirstKey Homes had a history of failing to keep its residences up to code for tenants.

In 2018, its rate of code violations was higher than other Memphis-area single family

rental owners. FirstKey even caught the attention of the Memphis Blight Elimination

Steering Team, which published a list of the top 10 residential code violators. For

occupied homes, Cerberus-owned properties were at the top of the list, with 46

violations at the beginning of 2018.

23

“They don’t care. They are just here to lease their properties without

consequence,” said Memphis Public Works Director Robert Knecht, who oversees

code enforcement.

24

A former FirstKey resident, Kelly Jones reported toilets that did not flush and that

she had holes in her floors, nonfunctioning air conditioning, and rats in her kitchen.

In 2018, Jones sued FirstKey Homes over the state of her home. The case settled

without trial within the year and Jones received a settlement of $5,000-$10,000 from

FirstKey, according to the Post.

25

In Indianapolis, Indiana, FirstKey Homes made the news for refusing to allow a

resident to move out of her home when she feared for her safety. Dorothy Black’s

home was shot at seven times while she was in her living room watching TV. When

Black tried to get out of her lease, FirstKey initially refused and noted that she would

be responsible for the repairs connected to the gunfire damage. It was only after

Black contacted the local TV station that FirstKey allowed her to move out, offering

to rent her a different home.

26,27

“They don’t care. They are

just here to lease their

properties without

consequence,” said

Memphis Public Works

Director Robert Knecht,

who oversees code

enforcement.

24

CERBERUS BUYS SINGLE-FAMILY RENTALS, LOCKING FIRST TIME BUYERS

OUT OF HOMEOWNERSHIP

In the Phoenix, Arizona area, Cerberus and FirstKey have been active buyers in

the single-family market.

Like other institutional single family rental landlords, Cerberus typically pays cash

and is willing to outbid individual homebuyers, including first time homebuyers

looking to make a home in Phoenix.

28

“Too many potential first-time buyers are now watching houses they want

purchased by a Wall Street investor,” wrote the Arizona Republic in April 2018.

29

Indeed, the Phoenix Business Journal reported that Cerberus purchased almost

600 homes between November 2017 and April 2018. Cerberus purchased homes

for under $300,000, which were in short supply, limiting the homes available to

first time homebuyers.

30

The homes are now rented under FirstKey Homes and

Phoenix-area partner Bullseye Property Management.

31

CERBERUS-OWNED UK-BASED LANDMARK MORTGAGES SUBJECTS

HOMEOWNERS TO “MORTGAGE PRISON”

In the United Kingdom, the Financial Conduct Authority (FCA) defines “mortgage

prisoners” as borrowers who are “unable to switch to a better deal even though they

[are] up to date with their payments.” As of January 2020, the FCA estimates

250,000 people are living in a mortgage prison, which arose out of the financial crisis

in 2008.

32

In 2016, Cerberus Capital Management acquired mortgages once held by UK-

based defunct bank Northern Rock and created a portfolio company, Landmark

Mortgages, to manage them. Cerberus bought the portfolio of 65,000 mortgages for

£13 billion from UK Asset Resolution (UKAR), a holding company of UK govern-

ment-owned businesses, claiming to the government that it would offer homeowners

better mortgage deals. At the time of the sale, UKAR noted: “by returning ownership

to the private sector the option to be offered new deals, extra lending, and fixed rates

should become available to them.”

33

CERBERUS CAPITAL MANAGEMENT’S THREE-HEADED ATTACK ON HOMEOWNERS, TENANTS

5

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project

“ Too many potential

first-time buyers are now

watching houses they want

purchased by a Wall Street

investor,” wrote the

Arizona Republic in

April 2018.

29

A rental home in Phoenix, AZ, where FirstKey Homes has contributed to the shortage of housing stock for first time

and individual homebuyers. Photo courtesy of FirstKey Homes.

The government’s sale of mortgages from Northern Rock as well as (also defunct)

Bradford & Bingley in 2018 have come under scrutiny by public officials including

Members of Parliament Seema Malhotra and Lord McFall of Alcluith. MP Malhotra,

leading the inquiry of the ordeal that created mortgage prisoners, in May 2019 stated,

“we will be looking to make recommendations about how to deal with the most

vulnerable cases and about whether the restrictions people face are right and fair.”

3

4

Lord McFall added, "in some of the case studies I’ve seen, people with a mortgage

would be paying an extra £40-50,000 in the mortgage before it's completed. That is

totally unacceptable.”

35

McFall had been told by UKAR that mortgage customers

would be able to renegotiate mortgage terms with Landmark, the same information

they had received from Cerberus.

For example, Mr. Neale and Rachel Neale reported to the BBC that they had kept

up to date with their mortgage payments, but that that did not keep Landmark from

issuing default notices. Unfortunately, with Rachel dealing with Crohn’s Disease,

Adrian had to resort to phoning Landmark to settle the issue each time. He said that

it had an adverse effect on his business as well, making it difficult to gain credit to

get building gigs: “It’s held me back massively really in my business.”

3

6

As of November 2018, Lisa and Mark Elkins paid close to 5 percent interest on

their mortgage, significantly more than market rate. Having borrowed £20,000 from

loved ones and working multiple jobs, their only option was to sell their home.

According to the BBC, the Elkins had paid an extra £30,000 since 2007, having

been trapped in the above market mortgage rates.

37

CERBERUS CAPITAL MANAGEMENT’S THREE-HEADED ATTACK ON HOMEOWNERS, TENANTS

6

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project

Endnotes

1

https://www.cerberus.com/ accessed Apr 2, 2020.

2

“

President Donald J. Trump Announces Intent to Nominate, Designate, and

A

ppoint Personnel to Key Administration Posts,” Media release, Aug 16, 2018.

https://www.whitehouse.gov/presidential-actions/president-donald-j-trump-an-

n

ounces-intent-nominate-designate-appoint-personnel-key-administration-posts/

3

https://www.cerberus.com/our-firm/leadership/dan-quayle/, accessed Apr 2,

2

020.

4

h

ttps://www.cerberus.com/our-firm/leadership/john-w-snow/, accessed Apr 2,

2020.

5

h

ttps://www.cerberus.com/investment-platforms/residential-opportunities/,

accessed Jan. 27, 2020.

6

h

ttps://www.firstkeymortgage.com/Asset_Management, accessed Feb. 3, 2020.

7

“

Wall Street Snaps Up Cheap Single-Family Rentals,” Bloomberg, Feb 16,

2018. https://www.bloomberg.com/news/articles/2018-02-16/wall-street-s-home-

r

ental-bets-shift-to-lower-end-u-s-houses

8

“

Cerberus Acquires GBP 13 Billion Portfolio of Assets from UK Asset

Resolution Limited (UKAR),” Media release, Nov 13, 2015.

https://www.prnewswire.com/news-releases/cerberus-acquires-gbp-13-billion-

p

ortfolio-of-assets-from-uk-asset-resolution-limited-ukar-300178324.html

9

“Eviction filings and code complaints: What happened when a private equity

f

irm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

c

omplaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

10

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

1

1

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

12

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

13

Shelby County, TN General Sessions Court Clerk, accessed Mar 30, 2020.

https://gs4.shelbycountytn.gov/216/Civil-Case-Downloads

14

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

15

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

16

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_stor

y.html

17

Clayton County recorder of deeds, accessed Feb.25, 2020.

18

Clayton County Magistrate Court, accessed Feb.25, 2020.

19

F

irstKey Homes LLC v. Angela Hollis et al., 2020CM07679 WD, Clayton

County, GA Magistrate Court, Mar 18, 2020.

20

M

otion for Default, Cerberus SFR Holdings LP v. Unknown Persons in

P

ossession, 2020-005427-CA-01, Circuit Court of the Eleventh Judicial Circuit,

Miami-Dade County, FL, Mar 27, 2020.

21

R

eturn of Service, Cerberus SFR Holdings LP v. Unknown Persons in Pos-

session, 2020-005427-CA-01, Circuit Court of the Eleventh Judicial Circuit,

M

iami-Dade County, FL, Mar 27, 2020.

2

2

Motion for Default Judgment, Cerberus SFR Holdings LP v. Hector Borrero

et al, COSO-20-002772, County Court for the Seventeenth Judicial Circuit,

B

roward County, FL, Mar 23, 2020.

23

“Eviction filings and code complaints: What happened when a private equity

f

irm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

b

iggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_st

ory.html

24

“

Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

h

ttps://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_st

o

ry.html

25

“Eviction filings and code complaints: What happened when a private equity

firm became one city’s biggest homeowner,” Washington Post, Dec 25, 2018.

https://www.washingtonpost.com/business/economy/eviction-filings-and-code-

complaints-what-happened-when-a-private-equity-firm-became-one-citys-

biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_st

ory.html

26

Ibid.

27

“Indianapolis renter upset she was asked to pay for damage from random

gunfire,” RTV6 Indianapolis, Nov 5, 2019.

https://www.theindychannel.com/news/call-6-investigators/indianapolis-renter-

upset-she-was-asked-to-pay-for-damage-from-random-gunfire, accessed

Feb.25, 2020.

28

“Investor named after mythical hellhound is snatching up metro Phoenix’s

affordable houses,” Arizona Republic, Apr 8, 2018.

https://www.azcentral.com/story/money/real-estate/catherine-

reagor/2018/04/07/investor-cerberus-firstkey-homes-snatching-up-metro-

phoenix-affordable-houses-homebuyers-renters/482973002/

29

“Investor named after mythical hellhound is snatching up metro Phoenix’s

affordable houses,” Arizona Republic, Apr 8, 2018.

https://www.azcentral.com/story/money/real-estate/catherine-

reagor/2018/04/07/investor-cerberus-firstkey-homes-snatching-up-metro-

phoenix-affordable-houses-homebuyers-renters/482973002/

30

“Single investor buying up affordable homes in Phoenix,” Phoenix Business

Journal, Apr 7, 2018.

https://www.bizjournals.com/phoenix/news/2018/04/07/single-investor-buying-

up-affordable-homes-in.html

31

https://www.realestatechandler.com/market-data, accessed Jan. 28, 2020.

32

https://www.fca.org.uk/data/understanding-mortgage-prisoners, accessed

Feb. 11, 2020.

33

“Northern Rock: US firm ‘misled’ UK government on mortgages,” BBC, Oct

22, 2018. https://www.bbc.com/news/business-45938487

34

“Hope for 'mortgage prisoners’ as MPs and regulator act to free them,”

The Guardian, May 25, 2019.

https://www.theguardian.com/money/2019/may/25/hope-for-mortgage-prison-

ers-as-mps-and-regulator-act-to-free-them

35

“Northern Rock: US firm ‘misled’ UK government on mortgages,”

BBC, Oct 22, 2018. https://www.bbc.com/news/business-45938487

36

“Northern Rock: US firm ‘misled’ UK government on mortgages,”

BBC, Oct 22, 2018. https://www.bbc.com/news/business-45938487

37

“Northern Rock: US firm ‘misled’ UK government on mortgages,”

BBC, Oct 22, 2018. https://www.bbc.com/news/business-45938487

CERBERUS CAPITAL MANAGEMENT’S THREE-HEADED ATTACK ON HOMEOWNERS, TENANTS

7

Pilar Sorensen

pilar.sorensen@PEstakeholder.org

312.545.2665

Private Equity

Stakeholder

Project